07 Dec Advice from Outsourced Accounting Experts: How to Prepare for Your Next Audit

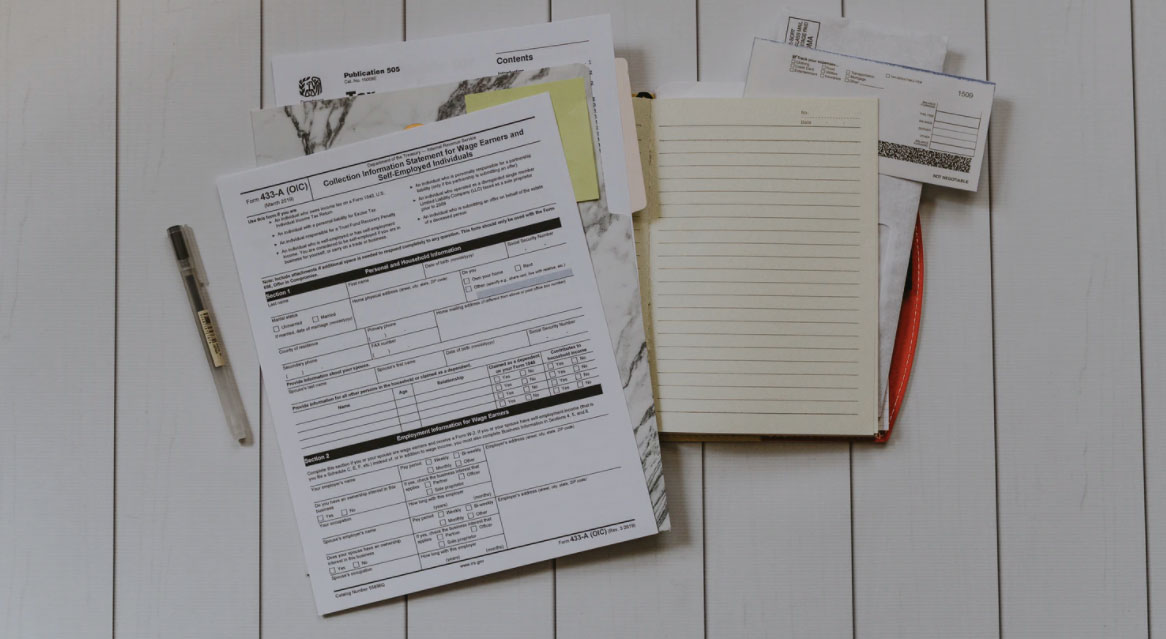

Audits aren’t typically top of mind for leaders of small or midsize companies. But when it comes time to have the finances audited—whether it’s an IRS audit, an external financial audit, or a due diligence review—it can quickly become a “drop everything” event. When an audit happens under pressure, and if your company is disorganized and missing supportive documentation, it can be costlier, less efficient, and more stressful than it needs to be.

As with most things in life, it’s always good to be prepared. Know what the potential triggers are and what your company can do to be prepared if an audit is on the horizon. Here are the top things to keep in mind when preparing for an audit:

When Do You Need an Audit?

Will your financials fall under increased scrutiny in 2021? The need for an audit could be a positive development—such as if your company is on a growth path and is pursuing funding opportunities—or it could be unexpected and intense (e.g., if you receive an audit notification letter from the Internal Revenue Service). Examples of triggers for an audit include:

Growth: For many young companies, a yearly audit of their financial statements doesn’t begin until they seek funding. Lenders may require an annual external audit as part of their debt covenant requirements, and many investors will expect to see audited financial statements before they’ll hand over their money.

Making an exit: If your exit strategy is to go public or to sell the company, the Securities and Exchange Commission and potential buyers, respectively, will want to see audited financial statements (you’ll need two to three years’ worth when you file with the SEC).

Red flags: The IRS audited one out 100 companies between 2010 and 2018. Some of the red flags or reasons your company could catch the taxman’s attention could be an improper use of or questionable deductions, filing an amended return, or company size.

SBA audit: We expect to hear of many PPP audits in the coming year. The Small Business Administration and Department of Treasury officials have said all loans over $2 million will be reviewed and noted that loans of any amount could be audited, too. Scrutiny will center on whether recipients of the pandemic relief lending program were in fact struggling and needed the financial lift.

Construct an Orderly Financial House

Ideally, of course, a company’s finances are in decent shape before any auditors start asking questions. By being organized, by having clear and consistently followed processes in place, it’s easier to go back to find what’s needed—including supportive evidence and reasoning behind the decisions that you’ve made. Your internal team or outsourced accounting experts can ensure that your financials are complete and prepared in accordance with U.S. GAAP; reconcile the accounts; verify assertions made around revenue, manage accounts receivable and accounts payable; check that major accounting and operational processes are documented, and tick and tie all the financial statements.

Team Up with Experts

Whether an audit is unexpected or a near-term possibility, one of the ultimate goals is to make it as smooth an experience as possible, to avoid disruption to the business—and your day-to-day job. If you have a lean internal team, having an outsourced accounting expert, fractional controller or outsourced CFO behind you to prepare all the reports and serve as the liaison during this time, can make all the difference. It can provide the extra sets of hands for the additional workload, alleviate much of the time pressure, and make meeting the auditors’ expectations as stress-free and efficient as possible.

Truthfully, at times, audits can be intense, particularly if it’s an IRS audit, and you want to be sure that the information provided is complete and done correctly—so that the audit duration isn’t stretched out farther than it has to be. Whether you need a helping hand during tax season, a liaison with your CPA firm, or it’s time to shore up your growing company’s finances, reach out to the outsourced accounting experts you might need for support.

No Comments